Pricing

Professional HOA & Small Business Accounting Services

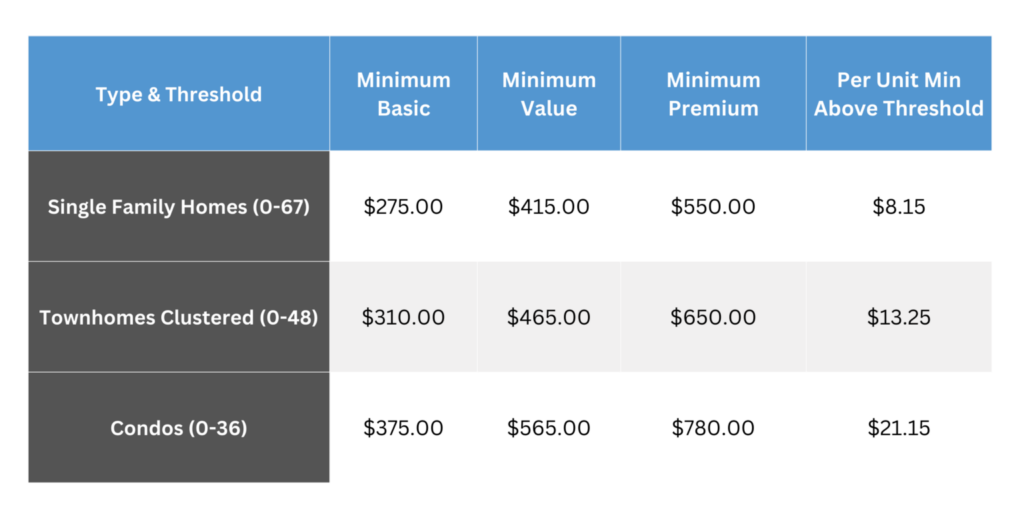

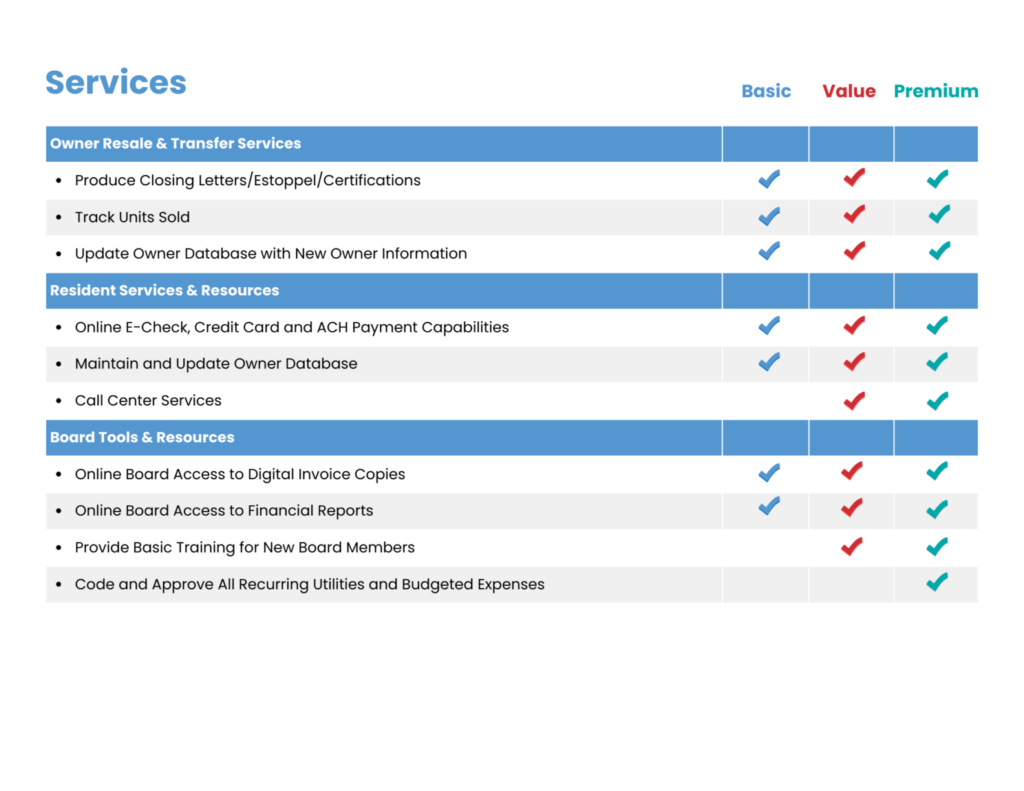

Pricing Matrix

We provide customized pricing for each community so that you only pay for what you need.

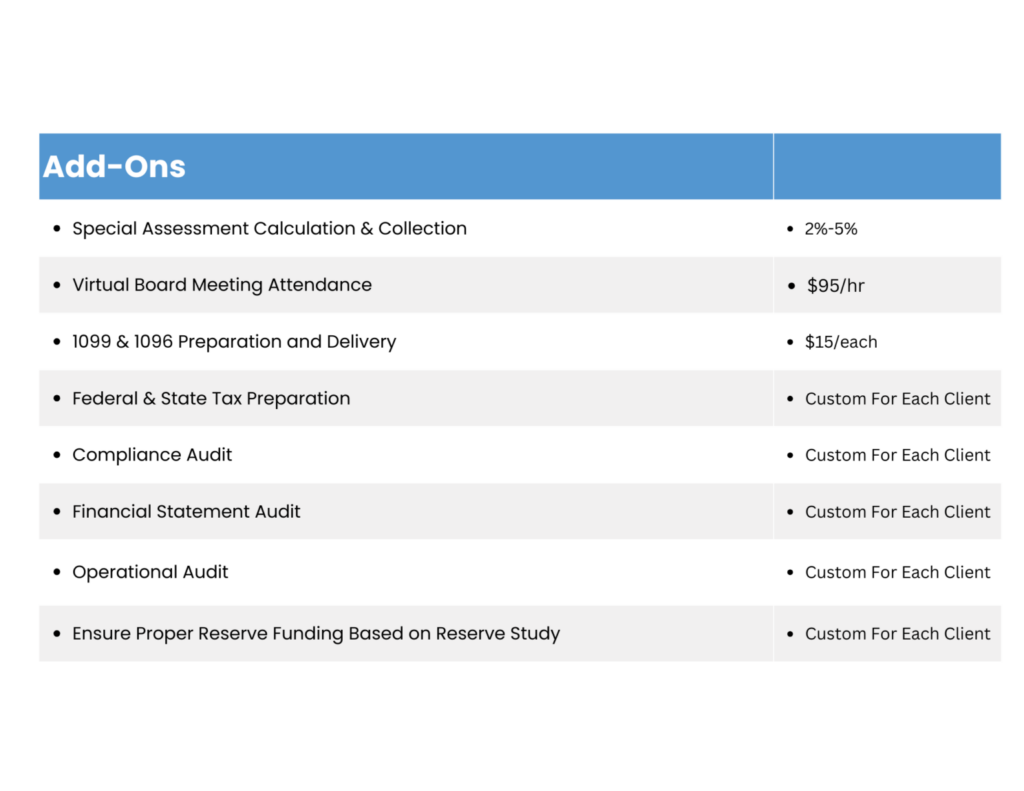

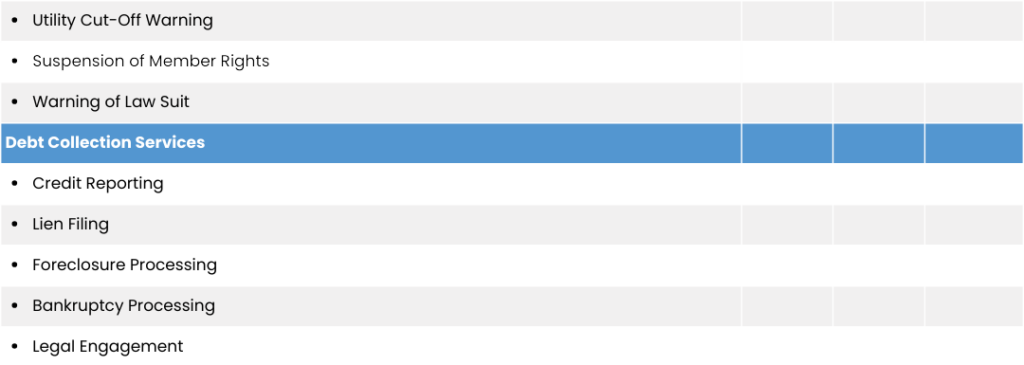

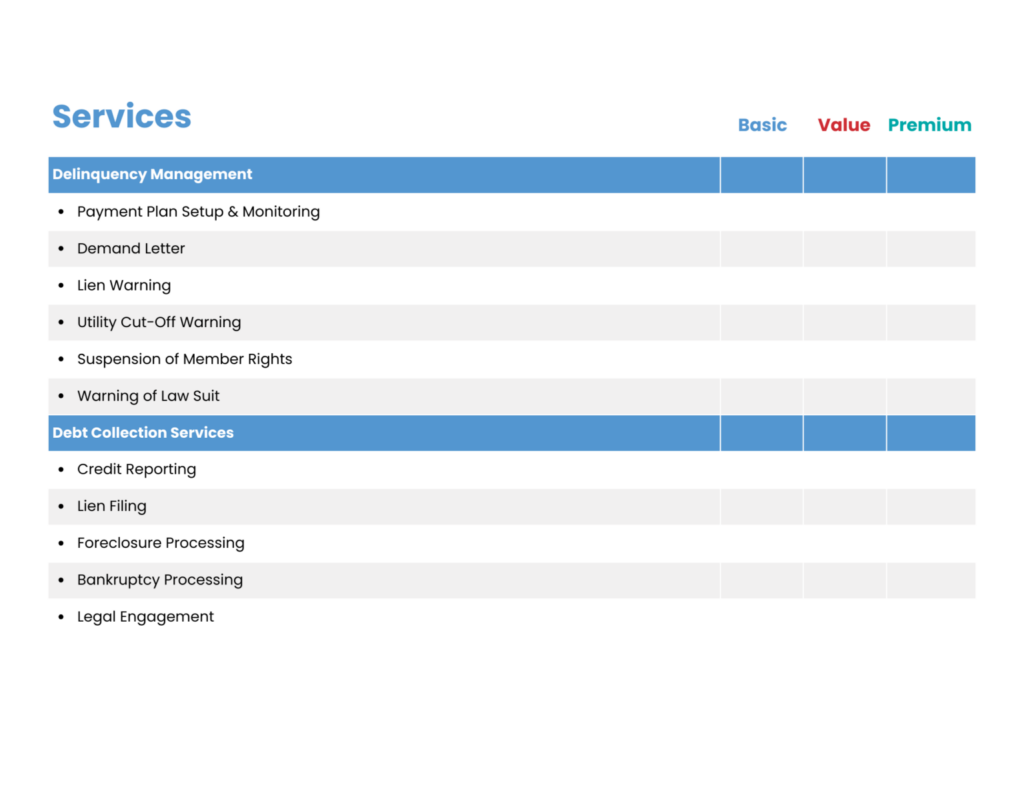

A La Carte Services

Need something added to your package? We offer flexible solutions for any community association.

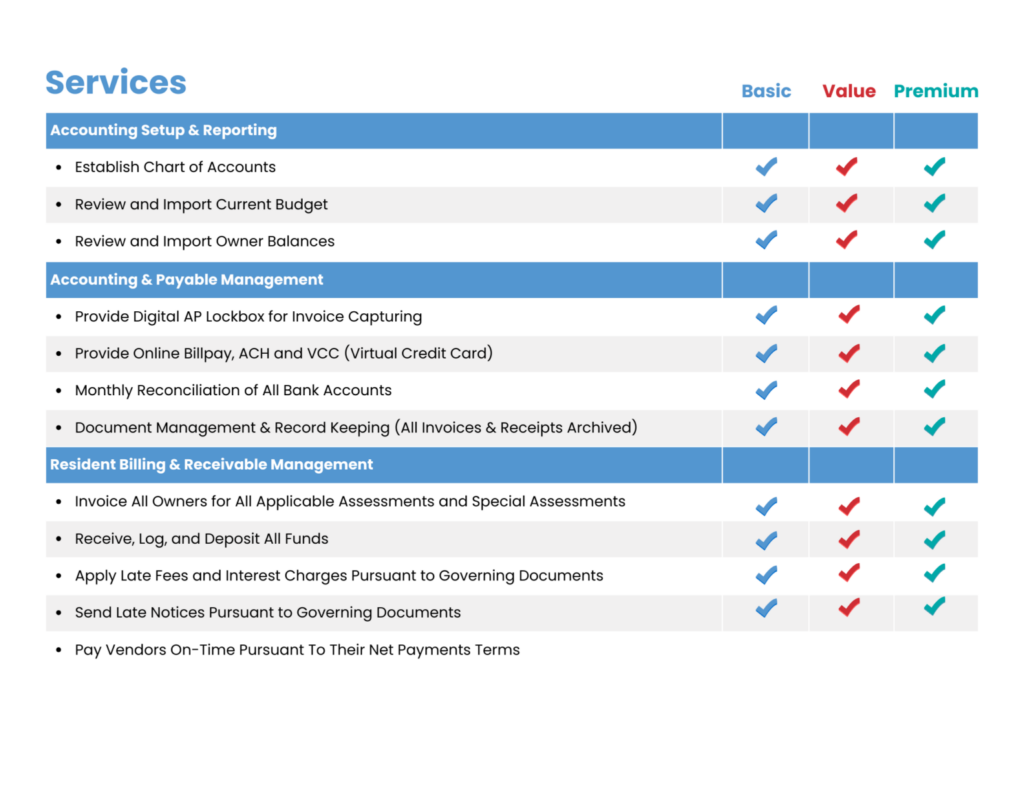

Prepackaged Services

Call Abel Accountants Now for a Free Community Assessment

Comprehensive Homeowners Association Accounting Services

Financial statement preparation

Provide regular financial statements that accurately reflect the organization's financial health.

Income and expense tracking

Track all income and expenses to ensure the completeness and accuracy of the HOA's financial records.

Compliance support

Help HOAs meet their legal and regulatory obligations by providing guidance on relevant rules and regulations.

Customized solutions

Tailored services that meet the specific needs of each HOA.

Auditing and assurance services

Auditing and assurance services to verify the accuracy and reliability of the HOA's financial statements and other financial records.

Professionalism and expertise

Experienced and knowledgeable professionals who can provide high-quality accounting services to support the financial stability of the community.

Let us simplify your HOA tax return process!

Don’t let your HOA tax obligations overwhelm you. Abel Accountants are here to help with specialized HOA tax preparation services. Call now to book a preliminary meeting with our HOA tax experts.